ANNUITIES/PURCHASED LIFE ANNUITY

Synopsis: The FTSE Group have launched a new index series designed to compare changes in the value of a pre-retirement fund with changes in annuity prices.

Date posted: Tuesday, February 17, 2015

The FTSE Group (now 100% owned by the London Stock Exchange) has launched the FTSE UK Level Annuity Index Series, a suite of six indices created in conjunction with Legal & General.

The indices are calculated daily, using the average of the three highest annuity rates (provided by The Annuity Exchange Ltd) for six different retirement profiles:

• Single Life – Early Retirement (60 years)

• Single Life – Standard Retirement (65 years)

• Single Life – Late Retirement (70 years)

• Joint Life – Early Retirement (65/60 years)

• Joint Life – Standard Retirement (70/65 years)

• Joint Life – Late Retirement (70/70 years)

Each index measures the change in annuity prices adjusted for the return on cash. In other words the indices will show whether holding cash on deposit is a winning strategy (index falls) or losing strategy (index rises). The interest rate used is SONIA (Sterling overnight interbank average), which is currently 0.45%. Thus at present movements in annuity rates – mainly driven by long term bond yields – will dominate changes in the indices.

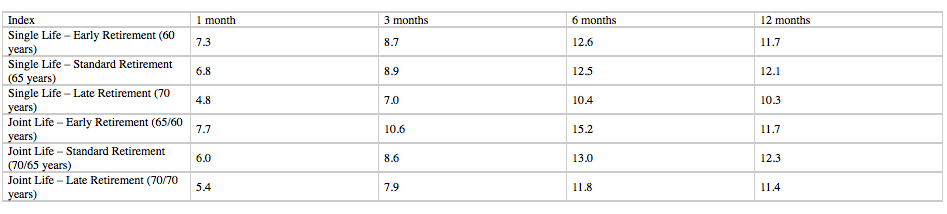

In background information on the index methodology there is an interesting table showing movements to the end of January 2015:

The increases reflect the fall in long term interest rates since the end of the year, which have the greatest impact on younger ages (as age increases, mortality gains in importance).

Why not talk to the professionals about properly managing your finances

Call us on 01273 457100 020 7871 5387 01403 333666

Or email us on info@opusgold.com

Or just take a look at how we help our clients www.opusgold.com